Summary:

Climate change is increasingly testing the foundations of insurance and reinsurance that underpin global supply chains, according to a new report from the Stockholm Environment Institute (SEI). Insured catastrophe losses have risen by an estimated 5–7% per year in real terms, as more frequent and severe weather extremes disrupt production, transport, and logistics across borders. When insurers withdraw from high-risk regions or activities, losses are pushed onto governments, businesses, and households, raising concerns about economic stability.

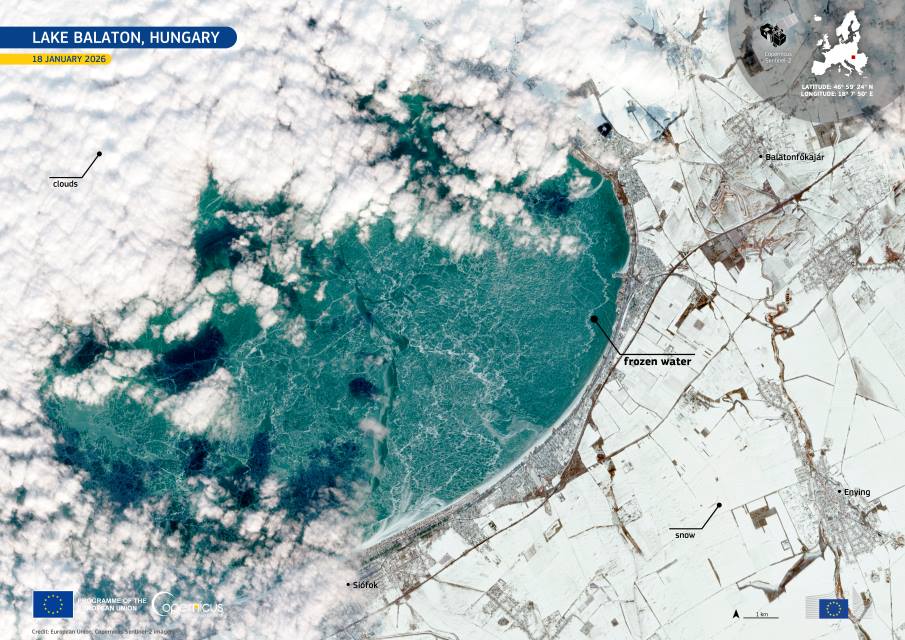

Recent events illustrate how local climate impacts can cascade through interconnected systems. Floods in Germany and Belgium in 2021 halted manufacturing and logistics across Europe, while droughts in southern Europe in 2022 reduced harvests and strained water supplies. “Climate shocks are now driving supply-chain shocks, cascading through interconnected networks rather than remaining isolated disasters,” says Dr. Mikael A. Mikaelsson, Policy Fellow at SEI and author of the report.

The report finds that traditional risk-transfer models are struggling to cope with correlated losses, limited data, and short underwriting cycles that clash with long-term climate risk. Without changes to regulation, business models, and public-private coordination, insurance may amplify systemic climate stress rather than absorb it.

— Press Release —

Climate risks to insurance and reinsurance of global supply chains – a new report from Stockholm Environment Institute shows

Global supply chains are increasingly exposed to climate-related disruptions, redrawing the boundaries of what can be insured and how risk is distributed across the global economy. In recent years insured catastrophe losses have grown by roughly 5–7% per year in real terms. As insurers retreat from high-risk geographies and sectors, the burden of loss increasingly shifts to public budgets, enterprises, and households.

Disruption of international supply chains are a major systemic risk for Europe and countries beyond – alongside food insecurity, energy instability and financial stress. The 2021 floods in Germany and Belgium paralysed logistics and manufacturing across Europe and droughts in southern Europe in 2022 cut harvests and strained water supplies.

“Climate shocks are now driving supply-chain shocks, cascading through interconnected networks rather than remaining isolated disasters. As local weather extremes ripple through interdependent systems, they can quickly become global shortages and delays that threaten economic security,” says Dr. Mikael A. Mikaelsson, Policy Fellow at Stockholm Environment Institute (SEI).

Insurance and reinsurance, the financial mechanisms normally absorbing these shocks, are being tested by the growing complexity, frequency, and severity of climate hazards. The report draws on interviews with leading experts from several of Europe’s top (re)insurance actors to examine how these sectors are responding to climate change challenges and the emerging limits of traditional risk-transfer models.

Without substantial changes to business models, regulation, and public-private coordination, there is a risk the sector will undermine stability by amplifying systemic climate stress, the report says.

“Climate risk is becoming systemic faster than insurance systems can adapt – and when losses can no longer be diversified, insurance stops working as designed,” says Mikaelsson.

Key findings:

- The physical and financial foundations of insurability are eroding. As hazards increase in number and intensity, assets concentrate in exposed regions and correlated losses across portfolios are undermining the principle of diversification on which (re)insurance depends, accelerating market withdrawals and widening protection gaps.

- While innovative solutions, such as parametric products, Contingent Business Interruption (CBI) cover and resilience-linked assessments, offer valuable tools, they are limited in scope and reliability.

- The scope of insurance coverage remains narrowly focused on assets and direct damages, excluding slow-onset, indirect and social dimensions of climate risk. Climate-related risks to human health and productivity among supply-chain workers are particularly under-recognized.

- Structural and technical limits – including reliance on historical data, incomplete climate-adjusted modelling, and fragmented risk metrics – undermine insurers’ ability to anticipate systemic exposure. There is a need for harmonized standards and forward-looking, probabilistic models.

- Short-term underwriting cycles and annual repricing prevent insurance from supporting long-term adaptation, since the focus on immediate solvency and profitability conflicts with the multi-decadal nature of climate risk.

- Risks to labour in supply chains are effectively invisible to current life and health insurance systems, particularly in physically exposed roles such as agriculture, construction, and logistics. Workers in such roles often fall outside formal insurance systems, and even when insured, climate-related illness, productivity loss, or mental health impacts are rarely recognized or compensated.

“Insurance alone cannot manage systemic climate risk. Without stronger adaptation, better data, and coordinated public–private governance, risk transfer will increasingly fail where resilience is needed most,” says Mikaelsson.

About the report

The report is based on a literature review and expert consultations with senior climate risk specialists across the European (re)insurance ecosystem. Based on the findings, three recommendations are directed at policymakers and regulators, the (re)insurance sector, and businesses whose operations depend on insurable and resilient supply chains.

Report:

Mikaelsson, M., ‘Insurance and reinsurance under climate stress: managing systemic risk in global supply chains’ (SEI working paper), Stockholm Environment Institute (2026). DOI: 10.51414/sei2026.002

Article Source:

Press Release/Material by Stockholm Environment Institute (SEI)

Featured image credit: Freepik